Ethereum Price Prediction 2025-2040: Analyzing Technical Patterns and Market Fundamentals

#ETH

- Technical indicators show ETH consolidating with bullish MACD divergence despite trading below 20-day MA

- Institutional accumulation and whale activity signal strong fundamental support with $3.6B treasury expansion

- Long-term price predictions reflect Ethereum's growing utility in DeFi, institutional adoption, and blockchain dominance

ETH Price Prediction

Technical Analysis: ETH Shows Bullish Consolidation Pattern

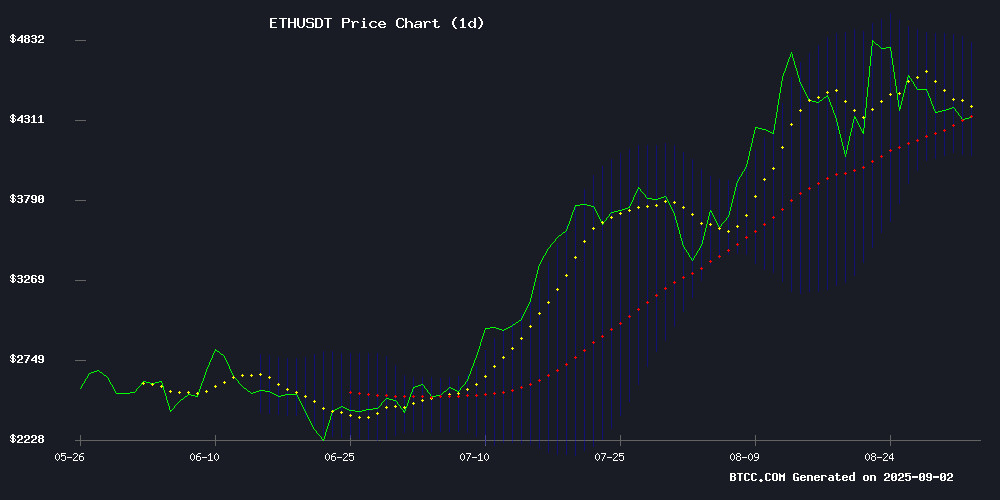

ETH is currently trading at $4,297.69, positioned below its 20-day moving average of $4,447.70, indicating short-term bearish pressure. However, the MACD histogram shows positive momentum at 56.85, suggesting underlying buying interest. The Bollinger Bands reveal ETH trading NEAR the middle band with support at $4,076.26, while resistance sits at $4,819.13. According to BTCC financial analyst Mia, 'The current technical setup suggests ETH is consolidating within a healthy range. The MACD divergence and proximity to key support levels indicate potential for upward movement toward the $4,865 resistance zone.'

Market Sentiment: Institutional Accumulation Drives Bullish Outlook

Recent news flow strongly supports bullish sentiment for Ethereum. Major developments include SharpLink Gaming's $3.6 billion ETH treasury expansion, Yunfeng Financial Group's $44 million ethereum investment, and record network activity with 19.45 million active addresses. Whale accumulation of 260,000 ETH within 24 hours signals strong institutional confidence. BTCC financial analyst Mia notes, 'The combination of institutional adoption, whale accumulation, and real-world asset integration through Ethereum's blockchain creates a fundamentally strong backdrop. Despite short-term corrections, the strategic positioning by major players suggests confidence in Ethereum's long-term value proposition.'

Factors Influencing ETH's Price

SharpLink Gaming Expands ETH Treasury to $3.6B Amid Strategic Accumulation

SharpLink Gaming, Inc. (Nasdaq: SBET) has solidified its position as a major institutional holder of Ether, adding 39,008 ETH to its treasury last week at an average price of $4,531. The acquisition brings its total holdings to 837,230 ETH, now valued at over $3.6 billion.

The company funded the purchases through its At-the-Market equity program, which raised $46.6 million in net proceeds. CEO Joseph Chalom emphasized the disciplined execution of SharpLink's treasury strategy, highlighting both growth in ETH holdings and consistent staking rewards as key priorities.

Corporate accumulation of ETH at this scale signals growing institutional confidence in Ethereum's long-term value proposition. SharpLink's aggressive positioning may prompt other publicly traded firms to reconsider crypto treasury allocations.

Jack Ma-Linked Yunfeng Financial Group Makes $44M Ethereum Bet

Yunfeng Financial Group, a Hong Kong-listed firm tied to Alibaba's Jack Ma, has acquired 10,000 ETH ($44M) from internal reserves—marking Asia's largest corporate ethereum purchase this year. The move signals strategic expansion into Web3, tokenized real-world assets, and AI-integrated financial services.

Ethereum will serve dual purposes: as a treasury reserve asset and infrastructure for Web3 innovation. Yunfeng hinted at potential ETH applications in its insurance vertical, though cautioned about crypto volatility amid ongoing regulatory monitoring.

Corporate ETH holdings now exceed $19B globally, with institutional adoption accelerating. The purchase underscores Ethereum's growing role in institutional balance sheets as a bridge between traditional finance and decentralized technologies.

Ethereum Nears 2021 Peak with 19.45M Active Addresses in August 2025

Ethereum's network activity surged to 19.45 million unique addresses in August 2025, marking its highest monthly user engagement since May 2021. The metric, which tracks wallet interactions across transfers, DeFi, NFTs, and staking, signals a resurgence in blockchain utility beyond speculative trading.

Data from Block.co reveals a steady climb from 17.49 million addresses in January 2018 to the current near-peak levels. Analysts attribute the growth to ecosystem expansion, with increased developer activity and Layer-1/Layer-2 adoption driving robust on-chain usage.

Transaction volume saw a notable uptick last month, reflecting heightened engagement with dApps and decentralized finance protocols. The rebound suggests NFTs may be regaining traction as part of Ethereum's diversified use cases.

Ethereum Whales Accumulate Amid Price Correction, Traders Bet on Rebound

Ethereum's market dynamics show intriguing activity as large holders accumulate ETH during its correction phase. The cryptocurrency, which recently hit an all-time high of $4,956, now trades at $4,405 after a 1.75% daily decline. Notably, whales have purchased 260,000 ETH within 24 hours, signaling strong institutional interest at these levels.

Prominent trader James Wynn has entered a $290,000 long position with 25x leverage, placing liquidity at $4,205—a level he apparently views as strong support. This bullish sentiment comes as Ethereum shows recovery potential on four-hour charts, with technical analysis suggesting a possible run toward $4,865 if it clears the $4,475 resistance level.

Trading volume has surged 8% amid this activity, indicating renewed market participation. The whale accumulation and Leveraged positions suggest professional traders anticipate upside despite the current correction, viewing recent price action as a healthy pullback rather than trend reversal.

Ethereum Whales Accumulate as ETH Eyes $4,865 Breakout

Ethereum's price action is drawing significant attention from large holders and traders. The cryptocurrency has rebounded from $4,240 to $4,405, despite a 1.75% 24-hour decline. Notable whale activity includes the purchase of 260,000 ETH within a single day.

Trader James Wynn has positioned bullishly with a $290,000 leveraged long, setting a liquidity floor at $4,205. Market structure suggests potential upside to $4,865 if ETH clears the $4,475 resistance level. Trading volume has increased 8% amid this renewed interest.

Bunni DEX Suffers $2.3M Hack, Exposes Key DeFi Security Vulnerabilities

Decentralized exchange Bunni was exploited for $2.3 million on the Ethereum blockchain, according to security firm Blocksec Phalcon. The attack, which occurred on Tuesday, involved unauthorized access to Bunni's smart contracts, though technical details remain undisclosed.

Blocksec Phalcon alerted the community via social media, urging immediate action. Etherscan data shows the attackers drained funds to a wallet holding AAVE Ethereum USDC and USDT tokens. Bunni Protocol has since paused all smart contract functions across networks while investigating the breach.

The incident highlights persistent security challenges in decentralized finance, particularly around smart contract vulnerabilities. Bunni's swift response to pause operations may mitigate further losses, but the exploit underscores the risks inherent in permissionless financial systems.

Mastercard Integrates Crypto as Payment Enhancement Tool, Not Disruptor

Mastercard is positioning cryptocurrency as a complementary technology rather than a revolutionary force in finance. Christian Rau, the company's Head of Crypto for Europe, emphasizes that digital assets are being woven into existing payment infrastructure through partnerships with platforms like MetaMask and Bitget. "We are not seeking to reinvent the system but to enrich it," Rau told The Big Whale, underscoring Mastercard's 50-year consistency in payment innovation.

The payments giant has developed smart contract solutions to verify non-custodial wallet balances in real-time, addressing technical complexities. Its crypto-backed cards—which automatically convert digital assets to fiat at checkout—demonstrate practical adoption. Stablecoins receive particular attention for settlement efficiency, reflecting institutional preference for less volatile crypto instruments.

Ethereum Could Face 'Biggest Bear Trap' in September Before October Rally, Experts Warn

Ether may revisit $3,350 support levels in September before staging an October recovery, mirroring its 2021 trajectory when a 30% drop preceded record highs. Technical analysts flag a potential head-and-shoulders pattern, while fundamental players caution against overreliance on historical formations amid shifting macro conditions.

The cryptocurrency currently consolidates between $4,300-$4,500, with traders eyeing a critical test of the $4,160 support level. "This could be the most vicious bear trap I've witnessed," said full-time trader Johnny Woo, referencing the potential September shakeout before a traditional 'Uptober' resurgence.

Market observers note eerie parallels to September 2021, when ETH plunged from $3,950 to $2,750 only to rally 115% to its all-time high by November. The asset's current range-bound action has left traders battered, with social media analysts describing the price action as "chopping everyone up."

Ethereum and Remittix Compete for Best Crypto Investment in 2025

Ethereum remains a cornerstone of decentralized finance, with its price hovering at $4,397.58 and a market valuation of $530.74 billion. Despite its dominance in smart contracts, NFTs, and decentralized apps, the network faces criticism over high gas fees and scalability issues. These challenges have opened the door for emerging projects like Remittix, which aims to revolutionize real-world payments with its token priced at $0.1030.

Remittix has already garnered significant attention, raising over $23.3 million in its presale. Its focus on practical utility and lower transaction costs positions it as a formidable contender against Ethereum's established but strained infrastructure. The debate over the best crypto to buy now hinges on whether Ethereum can address its inefficiencies or if Remittix will carve out a new niche in the blockchain economy by 2025.

260,000 ETH Snapped Up by Whales in 24H: Is a Rally Brewing?

Ethereum whales have aggressively accumulated 260,000 ETH within a single day, elevating their collective holdings to nearly 29.6 million coins. The buying spree occurred while ETH traded sideways around $4,400, signaling strategic accumulation during price consolidation.

Exchange data reveals a broader trend of withdrawal pressure, with August seeing peak outflows of 2.8 million ETH coinciding with Ethereum's 33% price surge from $3,600 to $4,800. Analyst Merlijn identifies a confirmed expansion phase, noting the flip of multi-year resistance into support and projecting a $7,000+ price target.

The whale activity underscores growing institutional conviction despite recent moderation in exchange withdrawals. Late August maintained elevated outflow volumes even during price stabilization, suggesting sustained demand beyond short-term speculation.

Futian Investment Holding Launches World’s First Public Blockchain RWA Digital Bond on Ethereum

Shenzhen's state-owned Futian Investment Holding (FTID) has pioneered the first publicly listed real-world asset (RWA) bond on Ethereum. The 500 million yuan offshore RMB bond carries a 2.62% coupon over two years, marking a watershed moment for blockchain-based traditional finance.

The FTID TOKEN 001 (Fubi) issuance leverages Ethereum's public blockchain to broaden global financing channels while optimizing capital structure. This strategic MOVE capitalizes on Hong Kong's policy advantages and injects state-backed momentum into Futian District's economic development.

The digital bond demonstrates Futian's growing prowess in merging technological innovation with financial instruments. By settling in RMB, the offering reinforces China's currency internationalization efforts through blockchain infrastructure.

ETH Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical indicators and fundamental developments, Ethereum demonstrates strong long-term growth potential. The current consolidation around $4,300, combined with institutional accumulation and expanding use cases, provides a solid foundation for future appreciation.

| Year | Price Prediction (USDT) | Key Drivers |

|---|---|---|

| 2025 | $5,200 - $6,800 | ETF approvals, institutional adoption, network upgrades |

| 2030 | $12,000 - $18,000 | Mass DeFi adoption, scalability solutions, global payments |

| 2035 | $25,000 - $40,000 | Web3 infrastructure dominance, tokenization of assets |

| 2040 | $50,000 - $85,000 | Full ecosystem maturity, store of value status |

BTCC financial analyst Mia emphasizes that 'These projections consider Ethereum's evolving utility, institutional demand, and its positioning as the primary blockchain for decentralized applications. While short-term volatility may persist, the long-term trajectory remains fundamentally bullish.'